Gold Market Summary for July 2025 and August Forecast: Monthly Gold Report by Global Broker Octa

Key Points:

- In July, a rather solid stabilizing stage in the price of gold occurred, and long-term forecasts remain positive.

- The major gold purchasing countries are experiencing the decreased physical demand of gold because of its high prices.

- Central banks are also sound purchasers but on a less aggressive scale in terms of accumulation.

- There were major logistical and refinery hubs where major supply flows were located.

- The main short-term driver is change in expectations on U.S. monetary policy, and a dovish turn in recent months is likely to improve the precious metal in the short run.

Monthly Overview

The month of July was a rather quiet period in gold market in comparison to other quarters. XAUUSD the prime instrument of trading in gold remained within a slender range of $30 trading between an approximate value of 3270 USD dollars and 3300 USD dollars on an ounce. This continued lateral drift, which has been in effect since May highlights their reluctance to invest and not to know which way to turn in the state of world uncertainty. Though the price of gold did not attempt new highs after significant rally in April, it was comfortably holding levels above the $3,000 psychological level and stayed over its 100-day moving average albeit briefly, again. There was an unusually low volatility in prices with no single session experiencing changes greater than 1.6 percent which is rare when it comes to volatile commodity. Investors mostly viewed July as a consolidation month and considered such factors as long time geopolitical uncertainties, tensions about trade differences and an economic policy change in the U.S. Significantly, XAUUSD recorded its initial monthly decline since December 2024 albeit by a slight margin as shown by a 0.4% slide.

This was during a turbulent period within the wider financial markets yet gold conducted itself in a very measured way. A small handful of isolated catalysts had any significant effect on price action last month:

Major market forces:

1-2 July: The U.S. Senate passed a broad tax cut and spending plan and in the two trading days thereafter, gold surged by more than 1.6 percent. Inflation was a concern due to the projected increase of the budget deficit of three trillion dollars within the next fifteen years. At the same time, negative ADP employment data strengthen the expectations of accelerated interest rates reduction by Federal Reserve.

11 July: A day later a 1 percent increase in gold was recorded following the promise by President Trump to impose a 35 percent on Canadian imports and a broad based 15-20 percent on other trade partners. The report elicited fresh risk aversion.

21-22 July: Gold prices increased more than 2 % in two days, reaching a five week high. Heightened tension on the markets in anticipation of the August 1 deadline that was to be met by the U.S. to implement a series of new trade tariffs against various nations contributed to such movement.

23-30 July: Conversely, in the last week of the month, prices of gold narrowed as it closed progressively. This turned around due to the advancement of global trade relations and Fed which voted to keep the rates unchanged without hinting at policy relaxation. The investor enthusiasm and dollars were buoyed by positive progress in the trade agreements with EU and Japan which took away the sheen of gold as a commodity. At the same time silver, platinum, and palladium also made their plays ending in significant losses.

Fundamental Landscape

Gold is in consolidation, though its overall macro and technical is bullish. Prices are remaining above critical support and moving averages and the momentum is still present. Wild U.S. trade policy, high fiscal and trade deficit worries and geopolitical forces are combining to provide a steady anchoring to gold prices at record level. A stable assistance is also being given by central bank interest and by structural demand. Nevertheless, people who expect further rallies need to be careful-the high prices of gold have already started to kill the physical demand in main markets of consumption.

Important Region Demand Trends

China

Being the biggest consumer of gold, the physical demand of China in the world market price rules has critical significance. There are recent data indicators of reduced appetite. China reported by Reuters that the net gold imports mainly through the Hong Kong fell by almost 60 percent in June relative to May to reach only 19.37 metric tonnes. This is in tandem with a 3.5 percent slump in powder gold intake on a national scale in H1 2025.

India

The demand is also pressuring India,which is the second-biggest buyer of gold in the world. The jewelry segment is taking it really hard because of sky high prices. World Gold Council projects that India gold consumption is expected to drop to a five year low in 2025 of 600-700 metric tons, on its way down to 802.8 mt in 2024. Although sales of jewelry have been weak, there is gaining momentum in the gold as ETF inflows propped up by 10 times in June.

Switzerland

Switzerland acts as a key centre of gold refining and trade. It has some of the largest gold refineries in the world which refine much of the newly mined and refined gold. Its trade statistics, therefore, convey useful indicators on the worldwide demand.

Swiss Customs reported 44 percent surge in exports of gold in June bringing it to highest level since March. Heavy bullion flows between USA and the UK which were largely driven by increase in bullions, processed through Swiss refineries. Particularly, the value of gold exports to the UK rose to 83.8 mt in June as compared to the May of 16.0 mt. Such reallocation is a strategic rebound of pre-existing channels of aufering of gold to the U.S. when its tariff fear had not materialized. Furthermore, London bullion market association registered 2.1% more gold in London vaults in June and this increased the holdings to their all time highs since August 2023.

Amount Accumulated by the Central Bank

Central banks keep adding to their gold as a long term strategic reserve asset to minimize the dependence on dollars and protect inflationary and economic shocks. The trend is not going to be slackening.

Bloomberg has reported that during June, China central bank (PBoC) continued to cut gold reserves in the bank, marking the eighth consecutive month of adding to stocks. The other major purchasers were the RBI of India and the BoR of Russia. To estimate these native figures, international broker Octa measured central bank purchases in the first half of 2025 of more than 400 metric tons of gold. Although this is down 20 percent on the H1 2024 level, with central banks continuing to be in net buying mode, keeping the market well supported with steady buying power.

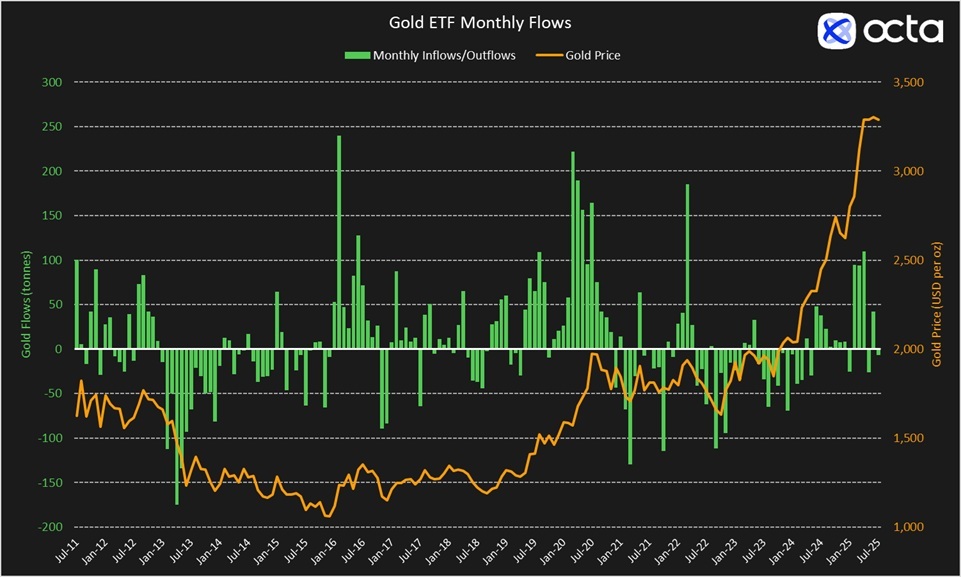

ETF Investment Business

The gold-backed ETFs continue to play an important role as a pillar of demand since it is an easy tool to provide balanced portfolio to retail, and institutional investors. Such investments have closely been associated with the general attitude towards gold.

According to the World Gold Council August, global ETF inflows ended at 74.56 mt (pending July), and North American funds accounted for almost 60 percent of the total. In line with the LSEG, physical gold ETFs had accumulated inflows that were slightly above 40 metric tons as at the end of the year. Only in January, May and barely in early July were outflows documented (see chart below). This is a gradual interest in the market investment level which shows the willingness of investors to have safe-haven assets in the market economy following conflicting signals.

Outlook of August 2025

Moving on, dovish Fed tone, the unresolved geopolitical risks, and macroeconomic data may be some of the factors that market volatility may be picked up in August. The policy agitators in the U.S. can bolster the prospect of a rate decrease, and gold can be benefited by weaker dollar and declining real returns. Besides, any emergent tension related to international trade or political instability would easily support the attractiveness of gold as a safe-haven asset.

Upside may be constrained, however, by weaknesses on the demand side. The constant elevated price might keep on hindering physical buying of gold in the major markets such as China and India. In the meantime, an upsurge in ETF inflows is again bound to be receptive to recurring developments in inflation outlooks and central bank responses.

Although we see short-term headwinds to gold, our structural argument to hold gold continues to be strong-backed by central bank buying, geopolitical unrest and lingering fiscal imbalances. Market strategists can consider extension of range-bound situations in the medium term, though longer term trends are still upside oriented.

Gold ETF flows versus price trends

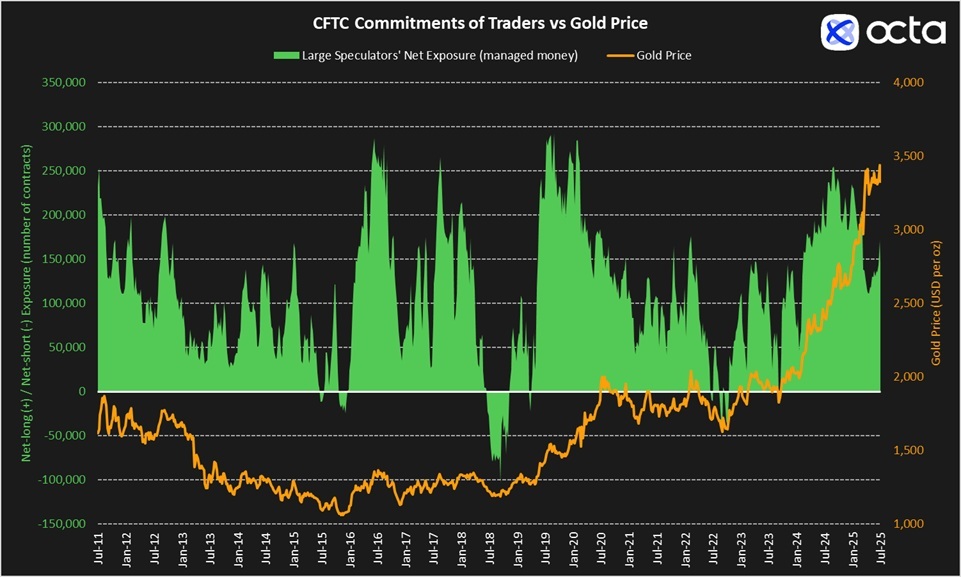

Speculative Sentiment: CFTC Commitments of Traders

In addition to central bank behavior, investors in general have been quite buoyant on gold. According to figures published by the U.S. Commodity Futures Trading Commission (CFTC) as at 29 July 2025, large speculative traders, (mostly hedge funds and money managers) remained net-long in COMEX gold futures and options. To specifically be long positions, there were 178,435 open long contracts against 35,589 short contracts leaving a net-long of 142,846 contracts (see chart below).

CFTC Commitments of Traders versus the price of Gold

‘Although large speculators remain net-long, the size of their exposure is substantially smaller compared to what it was back in September 2024, when the uncertainty around the U.S. Presidential elections fuelled bullish bets’, says Kar Yong Ang, a financial market analyst at Octa broker. ‘Still, while long positions may have been cut, short positions are not being added. Nobody wants to be caught shorting gold during these turbulent times’.

August and Beyond, Key Market Themes

The prospects of gold are still good. Nonetheless, a number of powerful determinants may change the situation in August and in the remainder of the year 2025. The analysts at Octa point out three key columns that affected the expectations of investors.

1. U.S Monetary Policy

This sudden response to the latest non-farm payroll (NFP) information is an indicator that the anticipations of the U.S. monetary policy remain to be the driving factor of the price path with regard to gold. Until now we were seeing skepticism mounting on the Federal Reserve readiness- and the ability- to undertake additional rate cuts. A report that recorded much lower-than-anticipated job growth and heavily negative revisions of the previous months during July was however a dovish signal that would shape the rest of the year.

Through early August, the market expectation has priced in 25-basis-point interest cut of the September month. Besides, the likelihood of a further depreciation in October is about 60 percent and a third reduction in December is about 47 percent.

‘With these dovish expectations in place, XAUUSD is likely to remain supported in the weeks ahead’, argues Kar Yong Ang. ‘However, inflation is a major concern and the Fed is yet to communicate its readiness to cut the rate. Tariff-related price increases are yet to be felt, and although U.S. consumer 1-year and 5-year inflation expectations have eased, they remain very high by historical standards. I think some central banks, and maybe even the Fed, will prefer to wait until trade tensions are resolved before committing fully to rate cuts.’

2. International Political Risk

The market fragility as a result of the global economic and political instability continues to be the major market volatility-fueler, especially the trade talk between the U.S and many of their trading partners, especially China. The tensions go way beyond trade as tensions in the Middle East (Israel-Hamas), and in South Asia (India-Pakistan), Southeast Asia (Thailand-Cambodia), and Eastern Europe (Russia-Ukraine) all contribute to the nervousness of markets.

The conflicts in the Middle East, such as the Israel-Hamas hostilities, brief spats between India and Pakistan, Israel and Iran, Thailand and Cambodia, and the ongoing conflict between Russia and Ukraine, have destabilised world politics and raised many fears ranging from oil and food supply disruptions to the prospect of a worldwide conflict. Gold, considered a ‘safe-haven’ asset, typically sees increased demand during political uncertainty and instability. While it is extremely difficult to project the resolution of geopolitical conflicts, let alone to forecast the emergence of new ones, peace negotiations in the hottest regions have already commenced. ‘Conflicting parties seem to have at least started to talk. A cease-fire in the Middle East and Eastern Europe is now more likely than it was only a month ago, but a lasting peace may take years to achieve. Either way, any progress in negotiations or even a temporary cessation of hostilities will improve risk sentiment and have a bearish impact on gold,’ says Kar Yong Ang, global broker Octa analyst.

3. Technical Structure of Markets

Kar Yong Ang comments: ‘At the end of July, it appeared like gold was getting under heavy bearish pressure and it looked like it was about to finally escape its two-month trading range and break below the 100-day moving average. With some big trade issues sorted out and the Fed being cautious about inflation, a price drop seemed pretty likely. But then, a surprisingly weak jobs report came out and completely flipped everything around.’

As a matter of fact, payroll miss rekindled expectations of monetary easing and depreciated the U.S. dollar which rose XAUUSD. This has caused short term technical sentiment to turn bullish.

Kar Yong Ang offers his perspective on the technicals: ‘In case XAUUSD rises above the critical 3,395 level and holds above it, traders will then almost certainly attempt to pull it towards the 3,426 level, where short-term consolidation may begin to take place again. However, a confident rise above 3,460 will open the way towards new all-time highs. Alternatively, only a drop below 3,300 will invalidate the underlying bullish trend’.

Trading Strategy using Octa

By trading gold on its proprietary platform, traders can enjoy speed of execution, tight spreads and professional analysis. The broker helps in gold trading by providing daily technical reviews, strategy animation, and all the informational educational facilities that are intended to assist different types of traders.

XAUUSD Daily Chart

August 2025: Macro Important Events

|

5 August |

U.S. ISM Services Purchasing Managers Index |

|

7 August |

Bank of England Interest Rate Decision |

|

7 August |

U.S. Jobless Claims |

|

12 August |

Reserve Bank of Australia Interest Rate Decision |

|

12 August |

U.S. Consumer Price Index |

|

14 August |

U.S. Producer Price Index |

|

14 August |

U.S. Jobless Claims |

|

15 August |

U.S. Retail Sales |

|

15 August |

U.S. Import Prices |

|

15 August |

U.S. Consumer Sentiment |

|

19 August |

Canada Consumer Price Index |

|

20 August |

Peoples’ Bank of China Interest Rate Decision |

|

20 August |

Reserve Bank of New Zealand Interest Rate Decision |

|

20 August |

UK Consumer Price Index |

|

20 August |

FOMC Meeting Minutes |

|

21 August |

S&P Global Flash Purchasing Managers Index |

|

21 August |

U.S. Jobless Claims |

|

21-23 August |

Jackson Hole Symposium |

|

26 August |

U.S. CB Consumer Confidence |

|

27 August |

Australia Consumer Price Index |

|

28 August |

U.S. Gross Domestic Product |

|

28 August |

U.S. Jobless Claims |

|

29 August |

Germany Consumer Price Index |

|

29 August |

U.S. Personal Consumption Expenditure Price Index |

Legal Disclaimer: This publication is informational only and is not to be taken as financial/investment advice. It does not consider your personal financial position, goals and risk tolerance. This article is not to be used in making any investment decisions, which are entirely on your responsibility. Octa and the authors of this material assume no responsibility whatsoever and do not represent the use of losses or damages arising out of the use.

About Octa

Octa is a globally established affiliate network company specializing in commission free financial market access since the year 2011. Having clients in more than 180 countries and over 52 million accounts opened, Octa has presented customised services by providing free webinars, market analysis, and educational materials that can serve different investment objectives.

The company is also keen on social and humanitarian activities, including enhancement of infrastructure in education and provision of rapid response relief facilities in regions lacking such provisions.

Octa is the recipient of more than 100 industry leading awards such as Most Reliable Broker Global 2024 by Global Forex Awards and Best Mobile Trading Platform 2024 by Global Brand Magazine.

Disclaimer: This sponsored market analysis is provided for informational purposes only. We have not independently verified its content and do not bear any responsibility for any information or description of services that it may contain. Information contained in this post is not advice nor a recommendation and thus should not be treated as such. We strongly recommend that you seek independent financial advice from a qualified and regulated professional, before participating or investing in any financial activities or services. Please also read and review our full disclaimer.