“Navigating Caution: A Trillion Reasons to Proceed with Care?”

“`html

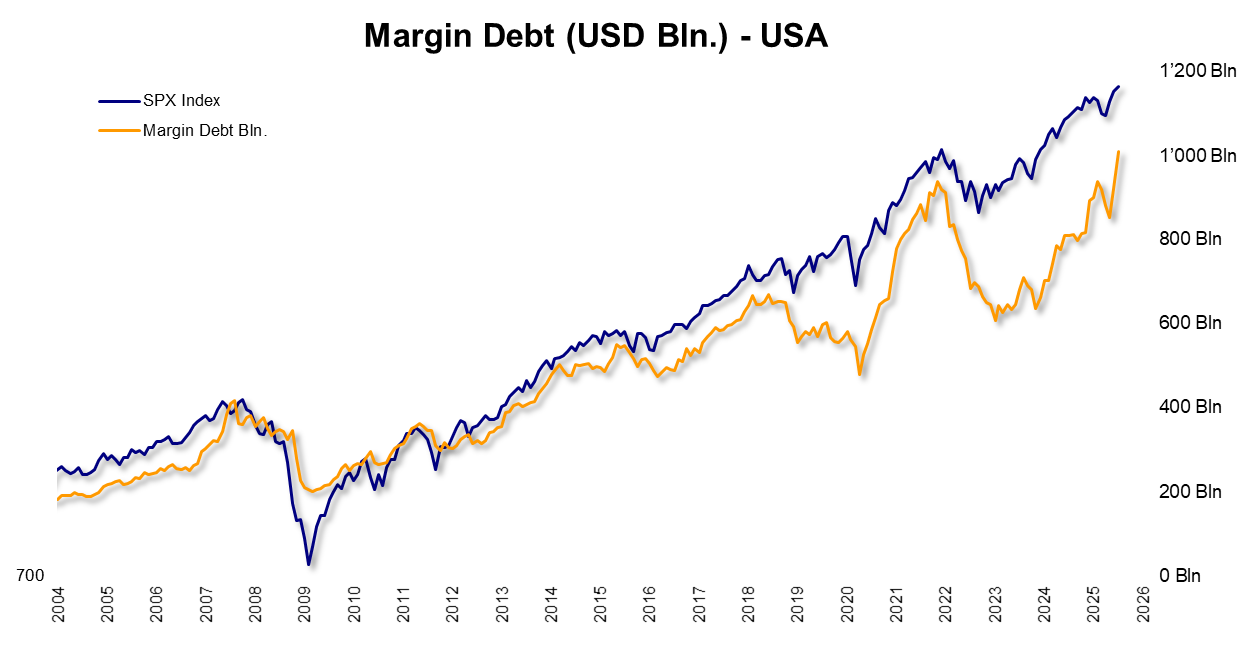

In recent Thoughts, we’ve delved into the stock market rally multiple times, consistently concluding that while the markets may rise a bit more, the risk of a sudden bear market is on the rise. We are not alone in this perspective; an increasing number of voices online are echoing similar sentiments. For instance, there are frequent mentions of a well-known warning sign: the new record levels of margin debts, which refer to credit-financed stock purchases.

These debts have the potential to inflict serious damage: if the market takes an unexpected downturn, such leveraged positions come under immense pressure. The outcome? Margin calls or forced liquidations.

Indeed, margin debt in the US has surpassed the trillion-dollar mark for the first time—a historic milestone. At first glance, one might assume that speculation is at an all-time high.

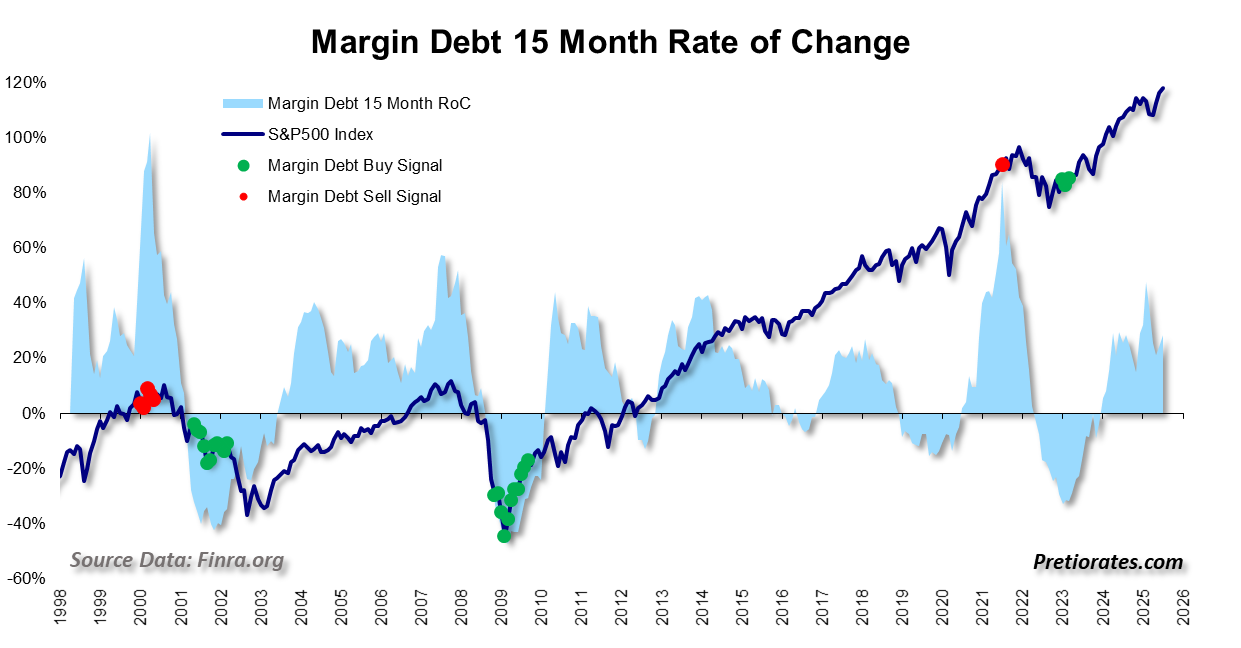

However, the situation is more complex than it appears. A historical review reveals that corrections typically occur when margin debt spikes sharply over a short timeframe. We analyze changes over a 15-month period; if the volume increases by more than 50% during this time, a correction often follows. Yet, currently, there are no warning signs indicating this is imminent.

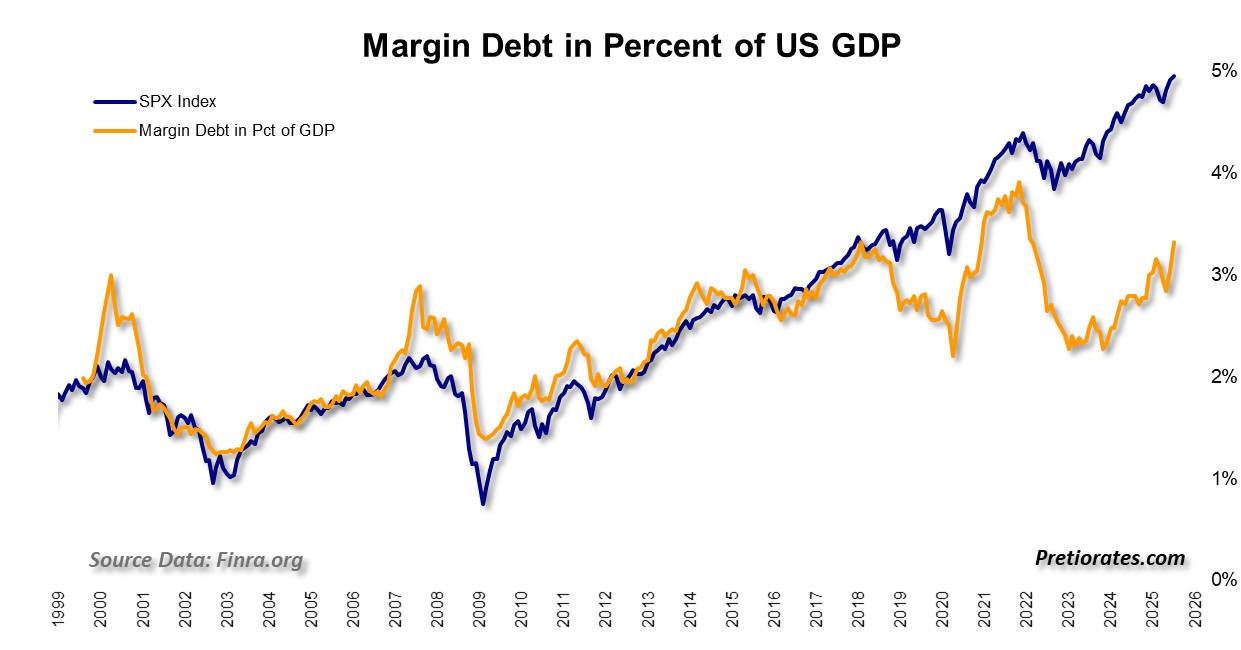

Moreover, absolute figures can be misleading. A trillion today does not equate to a trillion from a decade ago. The economy is expanding, and so is the money supply. In relation to economic output, speculative borrowing was significantly higher just three years ago.

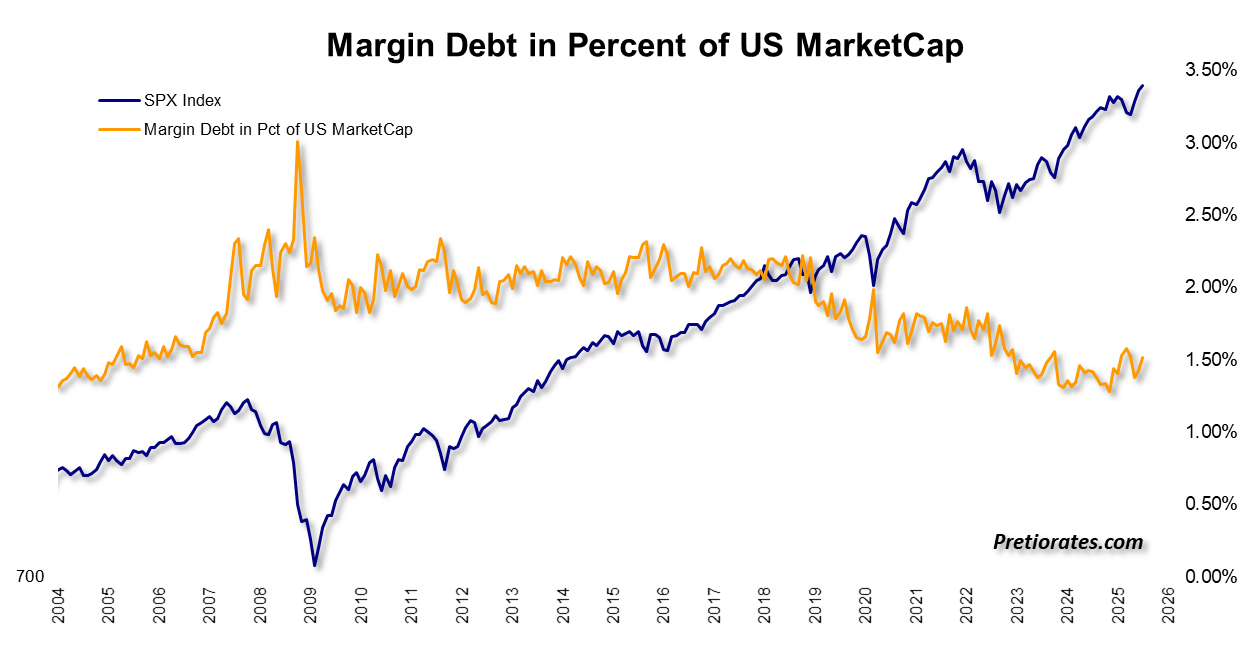

When we compare outstanding loans to the total market capitalization of all US stocks, we observe that the share of margin debt has actually decreased considerably over the past decade. One possible explanation is the increasing dominance of institutional and automated investment strategies.

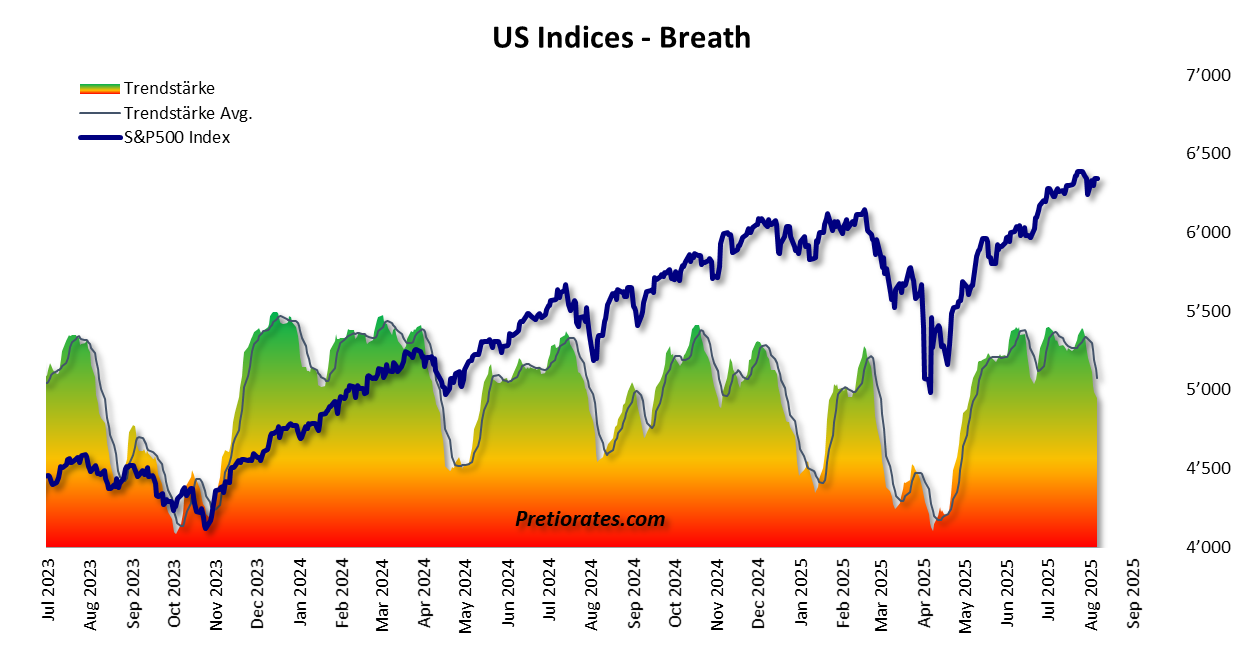

Nevertheless, even if margin debt isn’t currently causing alarm, the bulls are beginning to show signs of fatigue. The internal strength of US indices has weakened significantly in recent times.

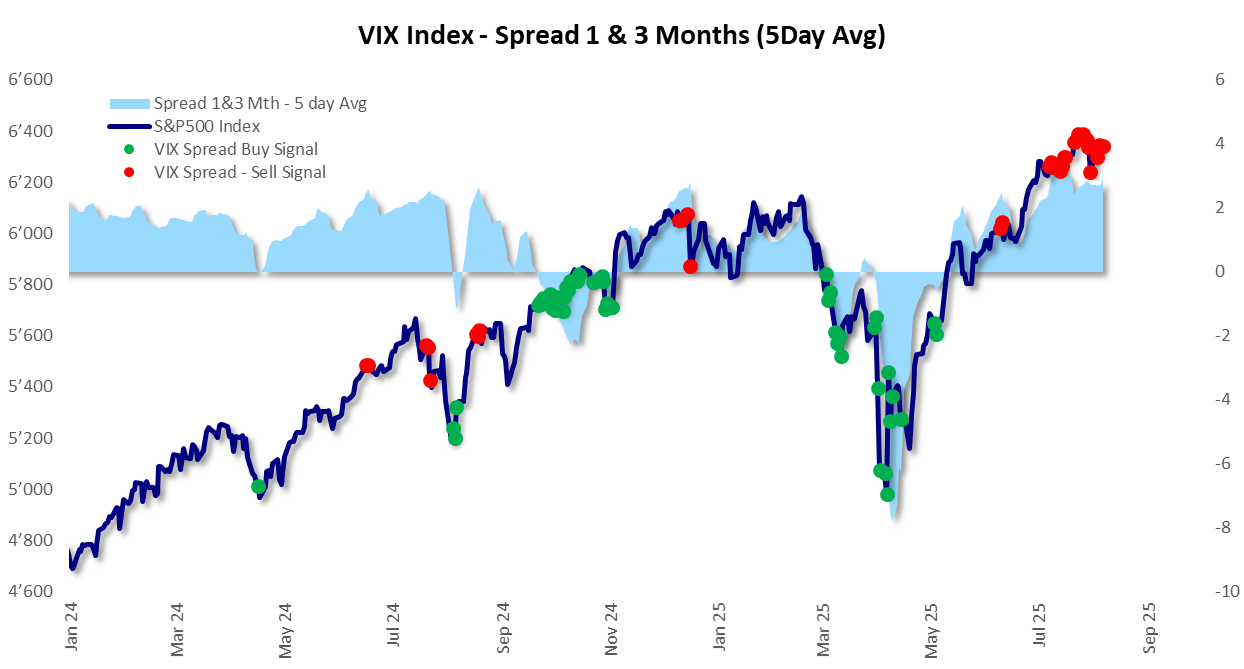

A glance at the VIX volatility index, often referred to as the “fear gauge,” supports this observation. When it is low, as it is now, fear appears to have dissipated. However, caution is warranted: the VIX reacts swiftly, and by the time it does, it is often too late for investors to respond. The VIX futures spread serves as a more reliable indicator, frequently signaling danger earlier—several warning lights have been flashing in recent weeks.

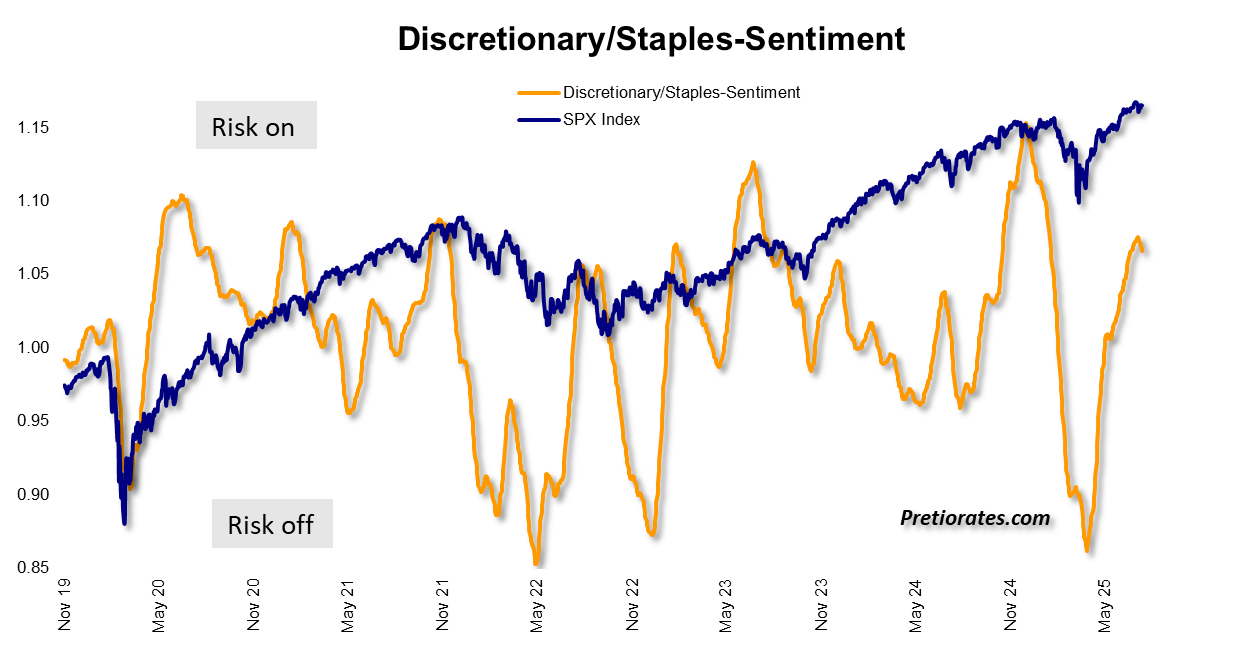

Another indicator to consider is the ratio between cyclical consumer stocks (discretionary stocks) and defensive consumer stocks (staples). When investors are optimistic about the economy, they tend to favor cyclical stocks. Conversely, when the outlook dims, they retreat to defensive stocks. This ratio has recently reversed direction, indicating an impending flight to safety.

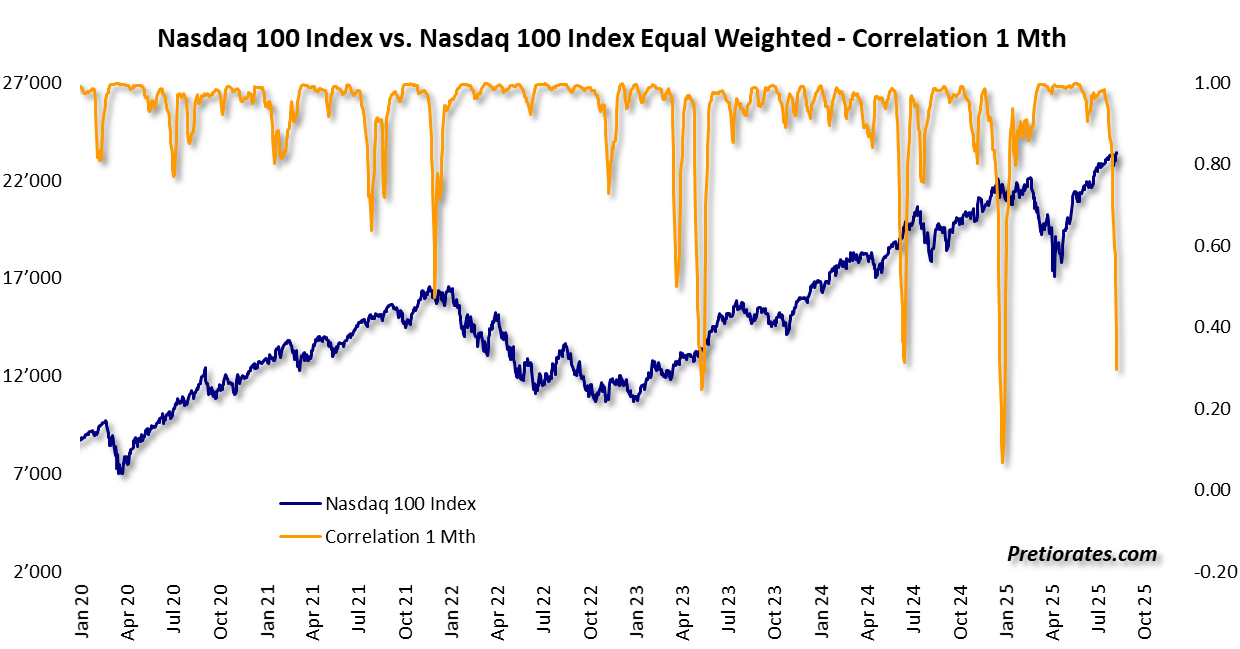

It’s also essential to look beneath the surface of the indices: while the Nasdaq 100 continues to shine, the equally weighted Nasdaq—where every stock has the same influence—is exhibiting increasing weakness. This is a clear indication that not all tech giants are keeping pace.

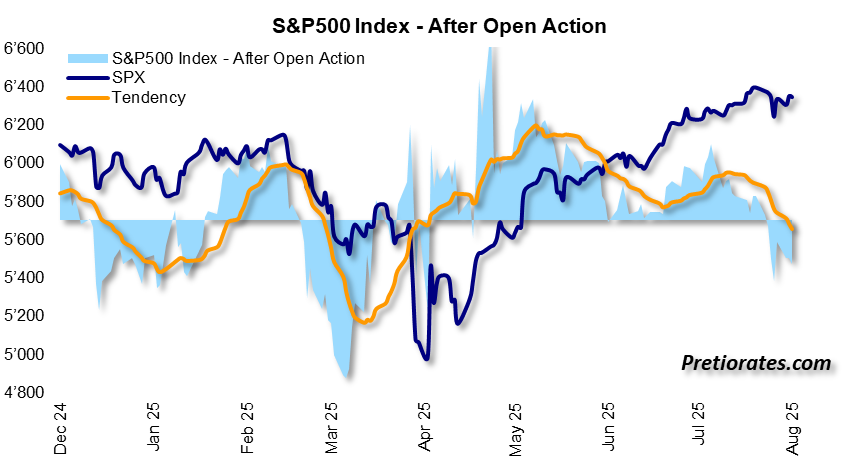

Short-term indicators further reinforce this narrative. The After Open Action indicator sheds light on the behavior of the “silent giants”—institutional investors with patience and capital. It is precisely these players who have gradually withdrawn in recent days.

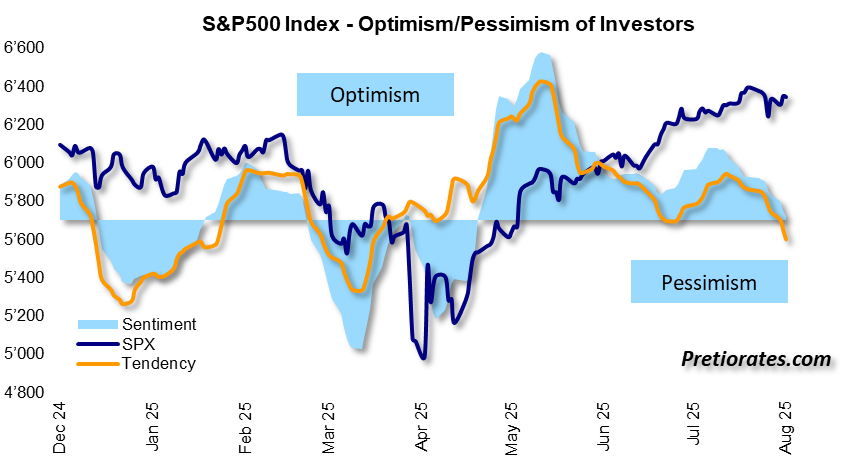

However, a significant price drop requires one final catalyst: the psychological tipping point. As long as market sentiment remains optimistic, even negative news is brushed aside. Yet, this is where a shift is occurring: the sentiment indicator is drifting into pessimistic territory.

Bottom line: The markets are elevated—and we have consistently warned about this, and quite early on. Yet, the foundations are beginning to tremble seriously. No one can predict precisely when or why a correction will occur. But when the house starts to creak, it’s wise not to linger inside for too long. It may not collapse entirely, but a falling brick can still cause harm. Thus, it wouldn’t be surprising if investors soon transition from risk on to risk off. As is often the case, we will likely only recognize the reasons for this in hindsight.

This content represents the author’s opinion and does not reflect the views of FinanceFeeds or its editorial staff. It has not been independently verified, and FinanceFeeds assumes no responsibility for any information or descriptions of services it may contain. The information in this post is not advice or a recommendation and should not be treated as such. We strongly advise seeking independent financial advice from a qualified and regulated professional before engaging in or investing in any financial activities or services. Please also read and review our full disclaimer.

“`