Pretiorates’ Thoughts 92 – A Trillion Reasons To Be Cautious?

In recent Thoughts, we have discussed the stock market rally several times – always with the conclusion that yes, the markets could rise a little further. However, the risk of a sudden bear market is increasing. And we are not alone in this view: there are a growing number of voices online coming to similar conclusions. For example, there are currently frequent references to a well-known warning sign – the new record levels of so-called margin debts, i.e., credit-financed stock purchases.

These have the potential to cause serious damage: if the market takes a sudden turn, such leveraged positions come under massive pressure. The result? Margin calls or forced liquidation.

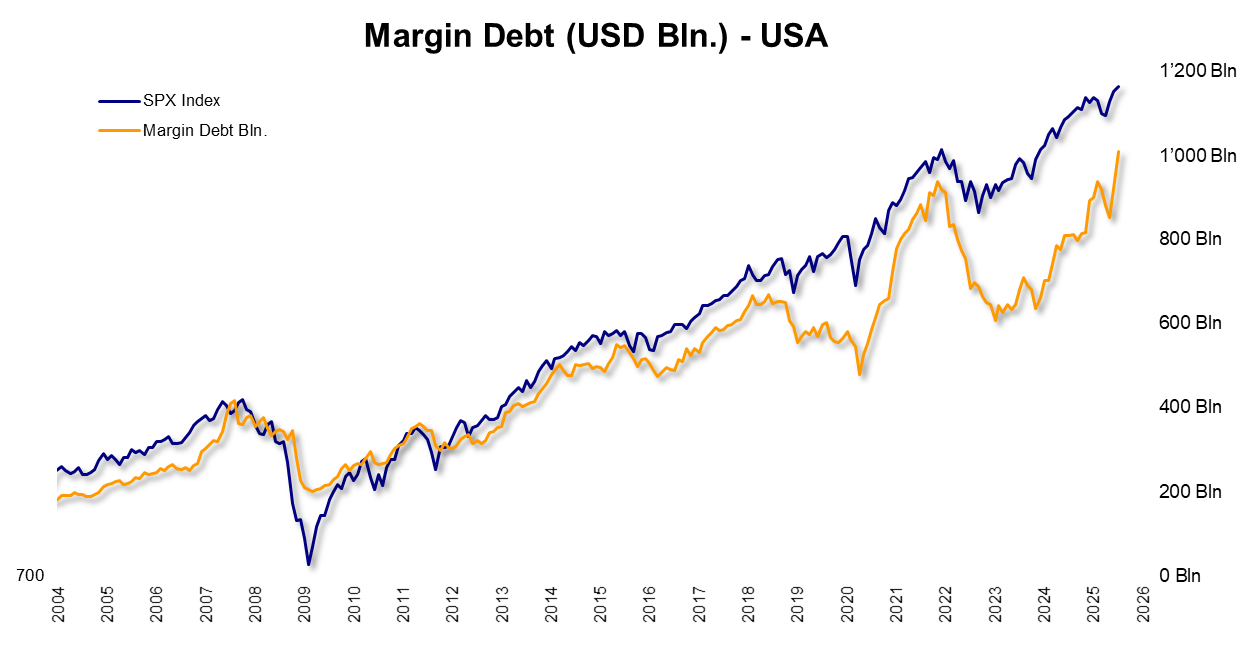

In fact, margin debt in the US has exceeded the trillion-dollar mark for the first time – a historic figure. Looking only at the headline, one might think that speculation is at an all-time high.

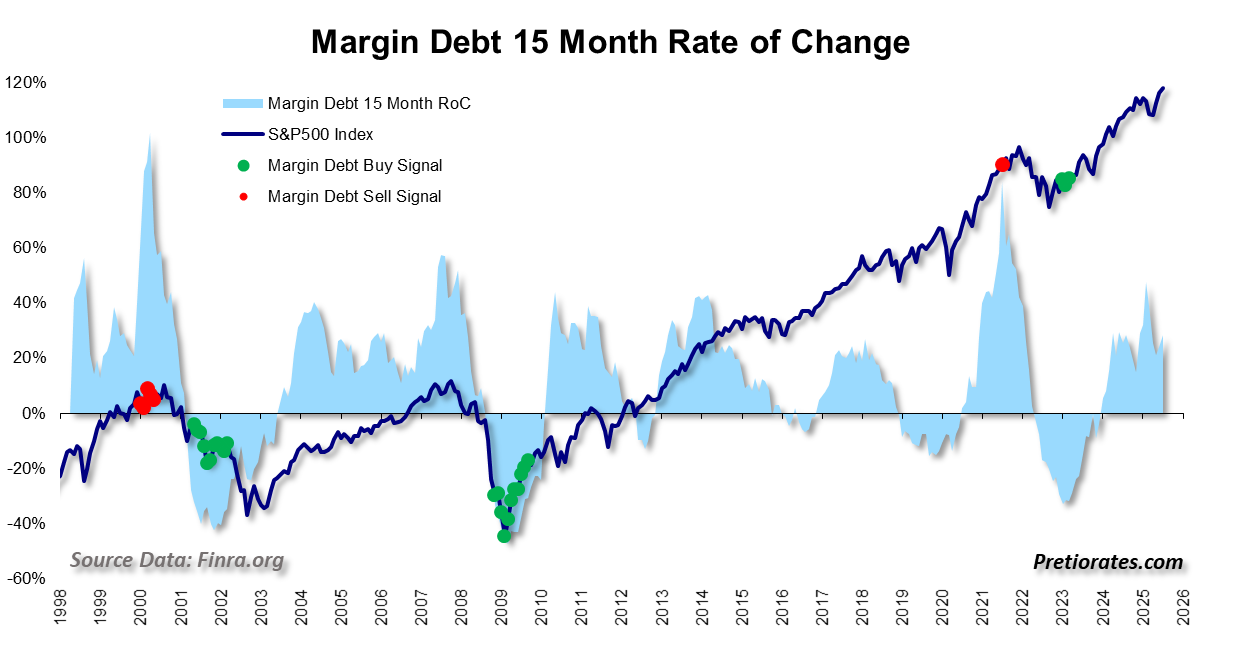

But it’s not that simple. Looking back, it’s clear that corrections usually occurred when margin debt rose particularly sharply over a short period of time. We analyze the change over a period of 15 months. If the volume rises by more than 50% during a period, a correction often follows. However, there are currently no warning signs of this happening.

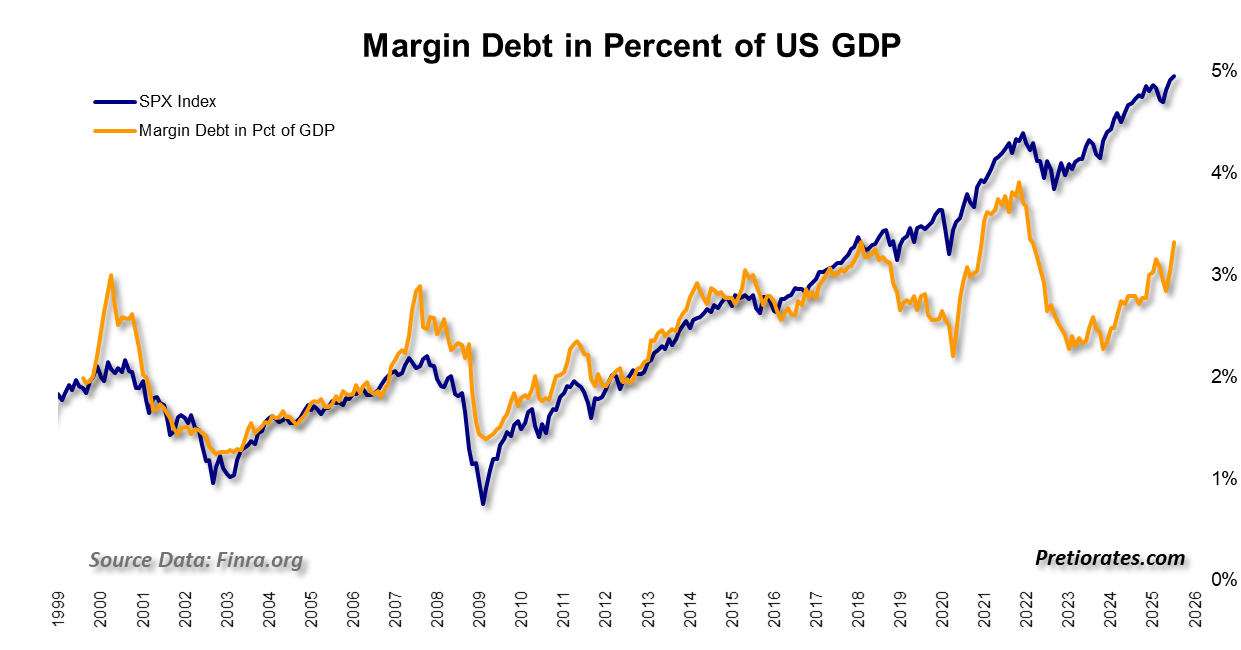

Furthermore, absolute figures say little. A trillion today is not the same as a trillion ten years ago. The economy is growing, and so is the money supply. In relation to economic output, speculative borrowing was even significantly higher three years ago.

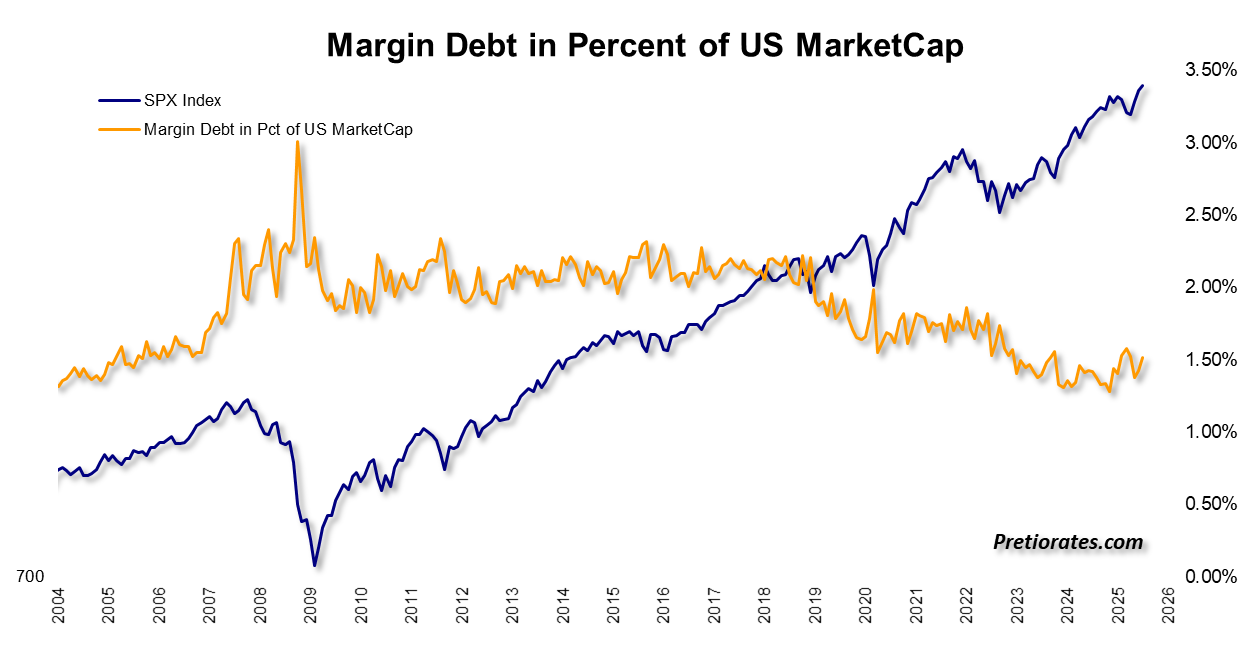

If we compare outstanding loans to the total market capitalization of all US stocks, we see that the share of margin debt has actually fallen significantly over the past ten years. One of many possible explanations is the growing dominance of institutional and automated investment strategies.

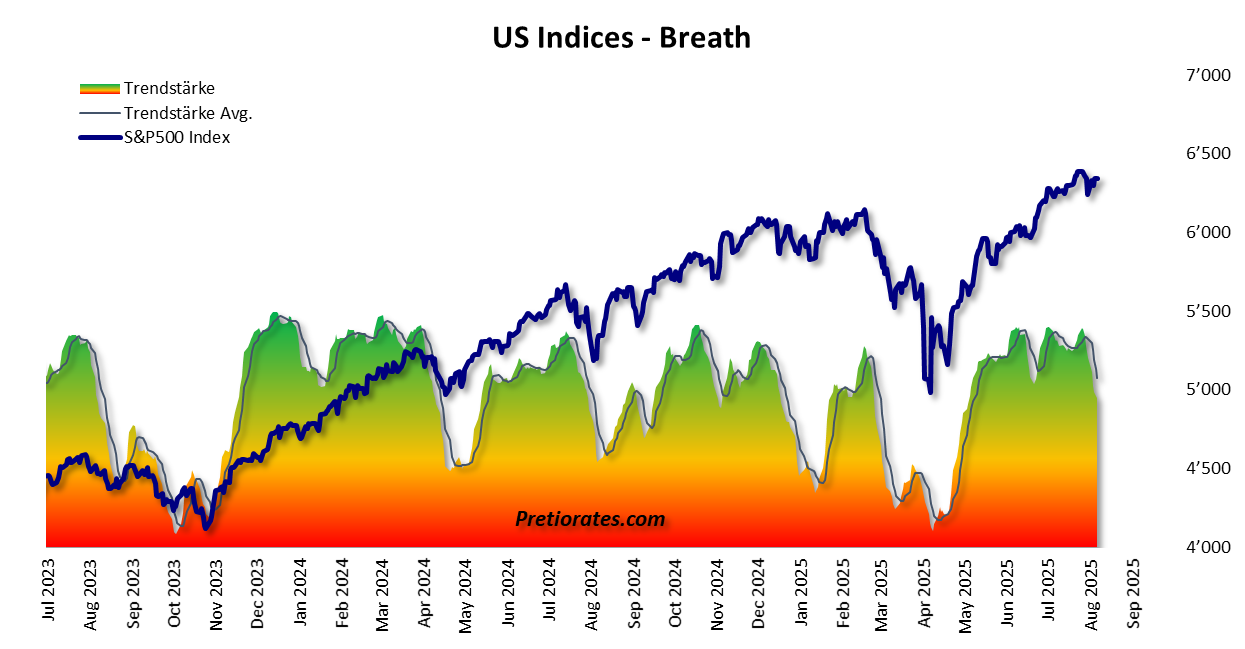

Nevertheless, even if margin debt is not currently causing us to panic, the bulls are showing the first signs of slowing down. The internal strength of US indices has weakened significantly recently.

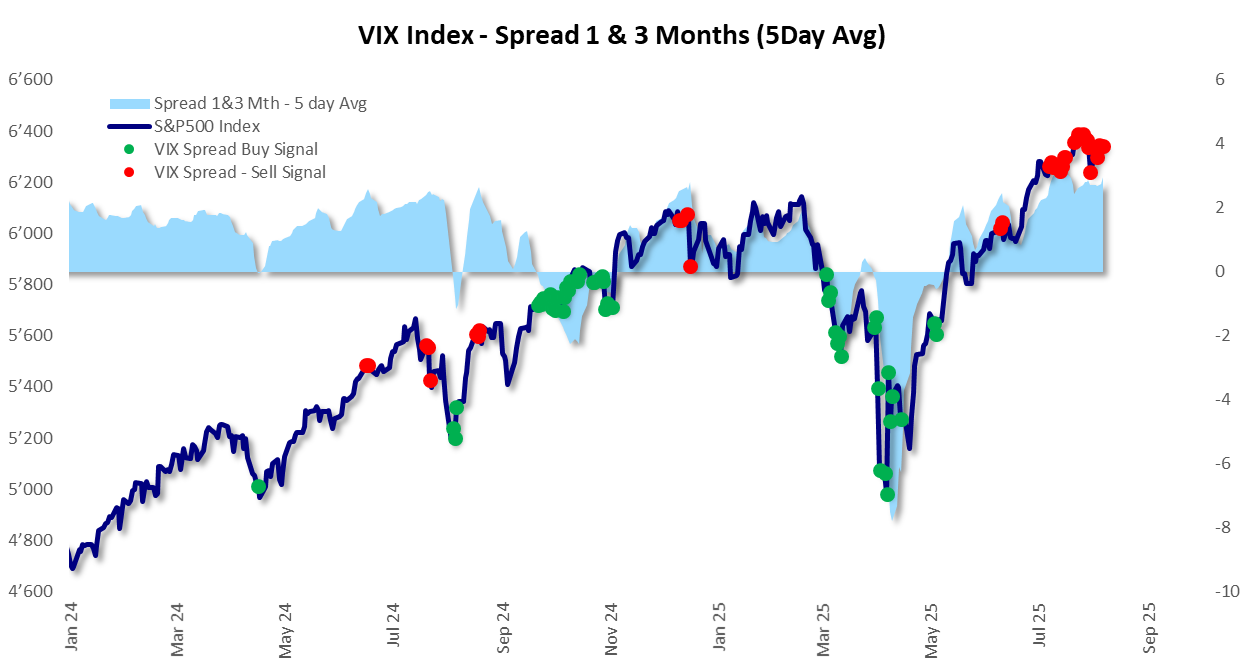

A look at the VIX volatility index, also known as the “fear gauge,” confirms this. When it is low, as it is currently, fear seems to have evaporated. But caution is advised: the VIX reacts quickly – and by the time it does, it is usually too late for investors to react. The VIX futures spread is a better indicator. It often signals danger earlier – and several warning lights have been flashing in recent weeks.

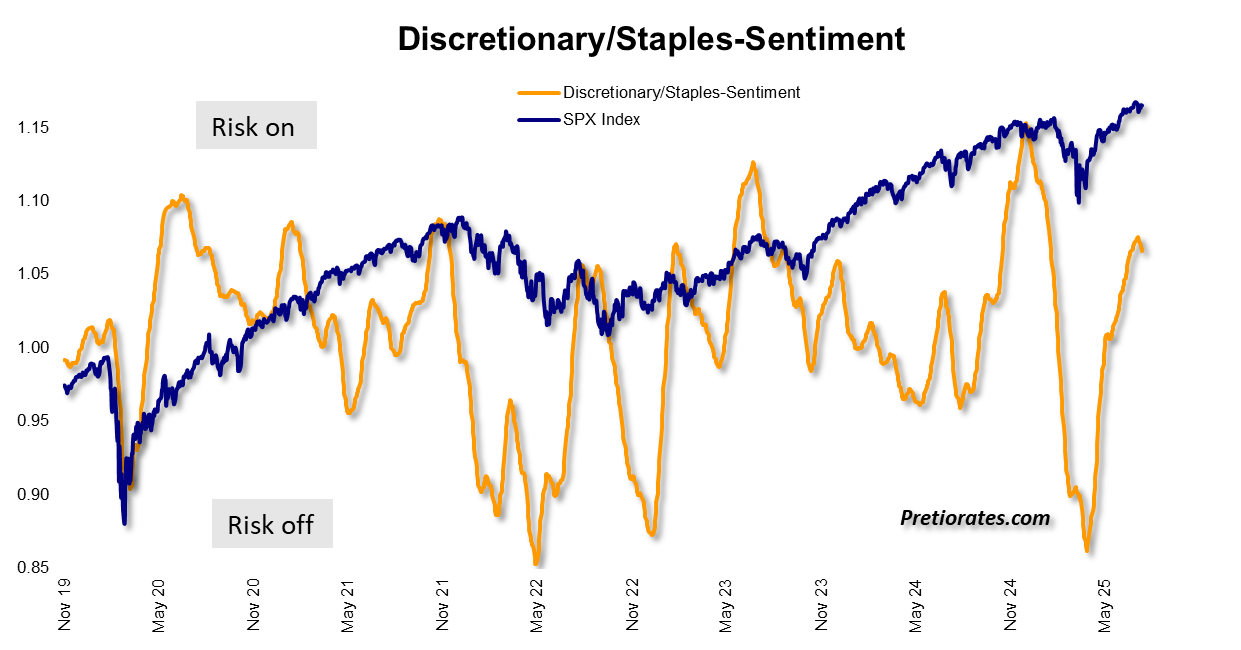

Another indicator is the ratio between cyclical consumer stocks (discretionary stocks) and defensive consumer stocks (staples). When investors believe in the economy, they bet on cyclical stocks. When the outlook clouds, they flee to defensive stocks. The ratio has just changed direction again, signaling an imminent flight to safety.

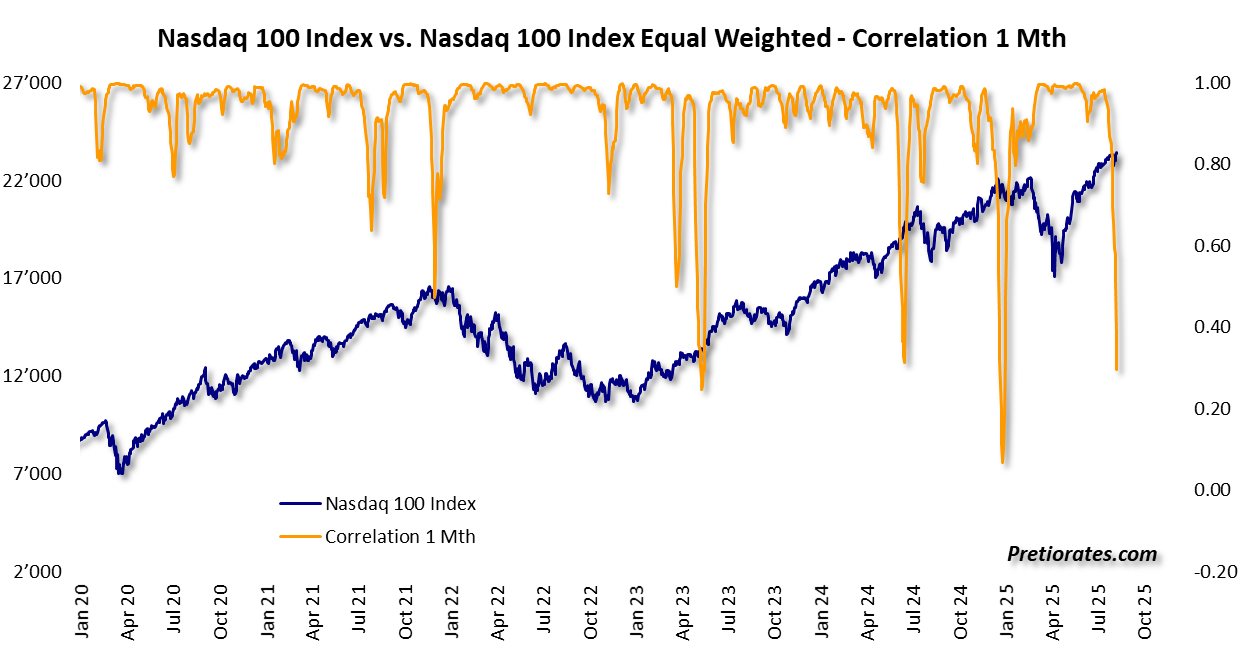

It is also worth taking a look beneath the surface of the indices: while the Nasdaq 100 continues to shine, the equally weighted Nasdaq – in which every stock has the same influence – is showing increasing weakness. This is a clear sign that not all tech heavyweights are keeping pace.

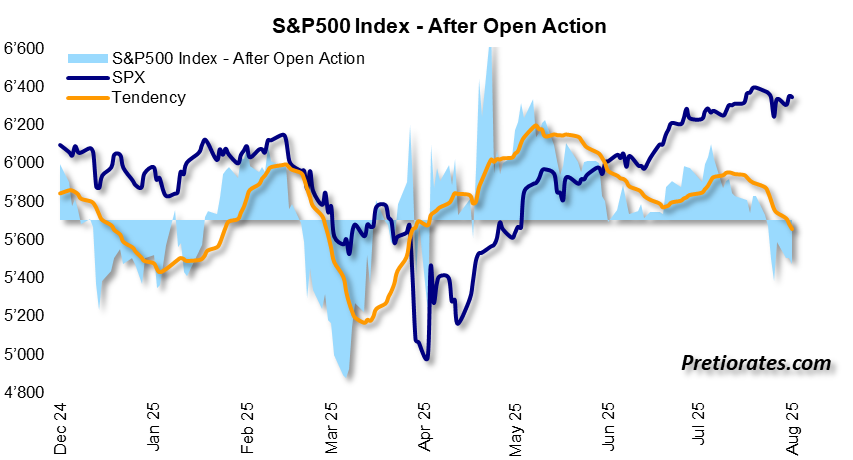

Short-term indicators reinforce the picture. The After Open Action indicator provides insight into the behavior of the “silent giants” – institutional investors with patience and capital. And it is precisely these players who have gradually withdrawn in recent days.

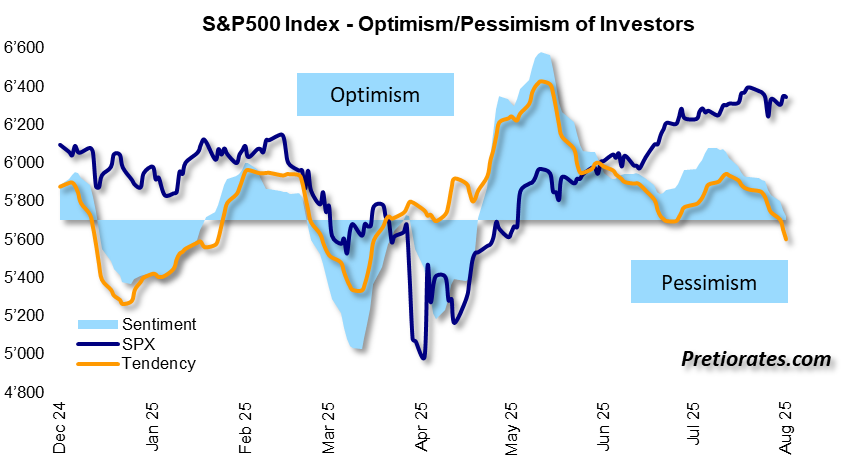

However, a real price slide needs one final push: the psychological tipping point. As long as market sentiment remains optimistic, even bad news is shrugged off. But this is precisely where something is shifting: the sentiment indicator is drifting into pessimistic territory.

Bottom line: The markets are high – and we have warned about this repeatedly and rather early. But now the foundations are beginning to shake seriously. No one can predict exactly when and why a correction will come. But when the house starts to creak, it’s better not to stay inside too long. It doesn’t have to collapse – but a falling brick is enough to hurt. So it would hardly be surprising if investors soon switch from risk on to risk off. As is so often the case, we will probably only recognize the reasons for this in hindsight.

This content is an opinion of the author and does not reflect the viewpoint of FinanceFeeds or its editorial staff. It has not been independently verified and FinanceFeeds does not bear any responsibility for any information or description of services that it may contain. Information contained in this post is not advice nor a recommendation and thus should not be treated as such. We strongly recommend that you seek independent financial advice from a qualified and regulated professional, before participating or investing in any financial activities or services. Please also read and review our full disclaimer.