Federal Reserve considers reducing stimulus as employment figures decline

Markets are calming down following the impact of a significantly weaker US jobs report released last Friday. Initially, there was a major downward revision from 147,000 to just 14,000 jobs for June. Additionally, the actual figure for July was 73,000, falling short of the expected 110,000.

This led to a substantial bearish correction on the Dollar index, DXY, exerting pressure on the Dollar against other currencies. Bitcoin and Gold experienced gains after the report, whereas Crude oil had already been undergoing a bearish correction, largely due to OPEC’s decision to increase supply production.

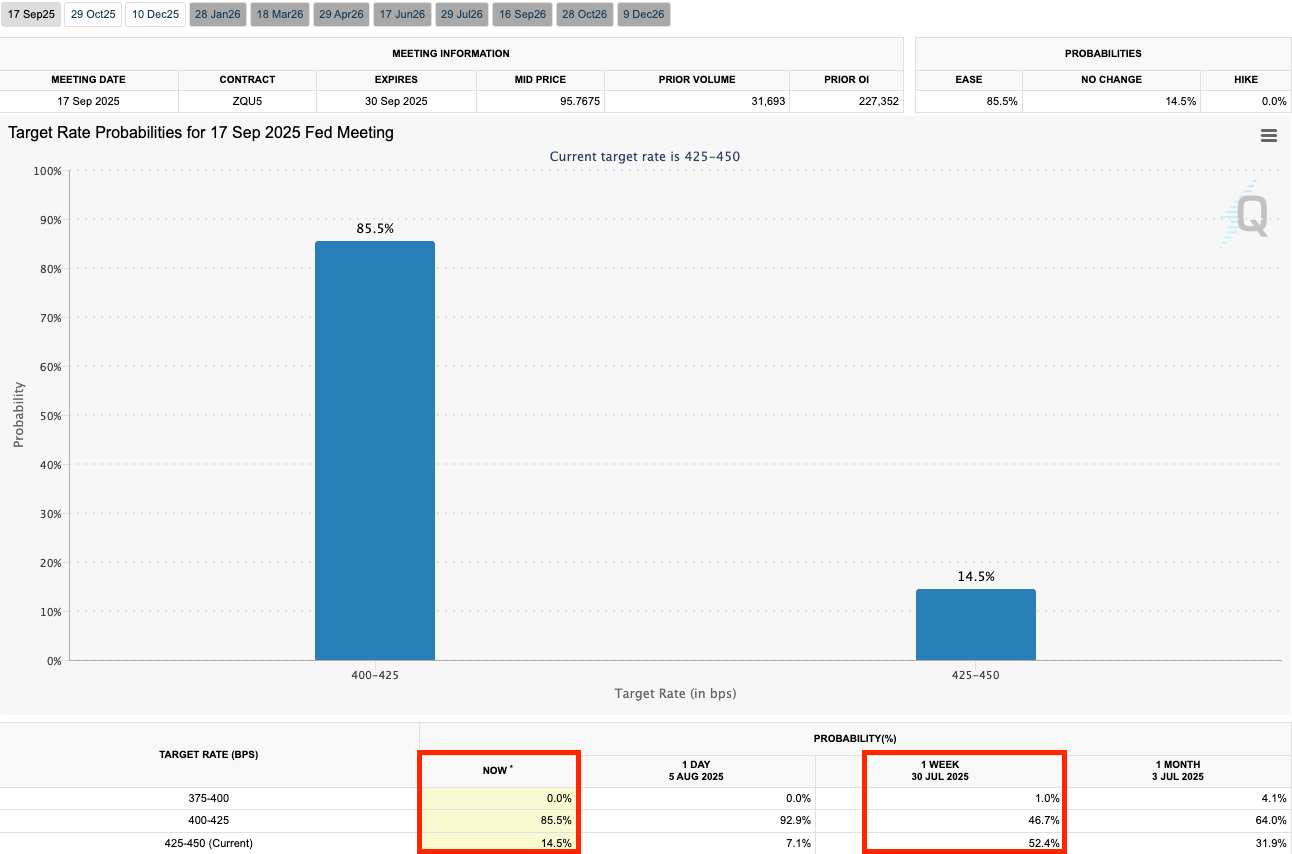

Before the NFP report, the FedWatch tool indicated a 53% probability of the Fed holding rates at the September meeting and a 47% chance of a rate cut. However, post-NFP, the probabilities have shifted significantly towards a rate cut, now standing at 85%.

Next week, the US inflation data will be released, with the headline figure expected to remain steady at 2.7% and the core figure anticipated to rise by 0.1% to 3%. Any surprises in these numbers are likely to cause further fluctuations in the Fed’s September meeting probabilities.

Bitcoin profit-taking impacts sentiment

Last week, Bitcoin recorded its highest realized profit to date, with over $3.7 billion distributed as of July 29, according to Glassnode. Following this, Bitcoin has faced challenges in recovery, indicating a shift towards short-term profit-taking and distribution. This shift is reflected in the fear and greed index, moving from extreme greed (74% on July 30) to neutral levels (54% on August 6).

The sentiment change could be temporary, driven mainly by profit-taking, or it might signal a short correction in the recent bullish trend. Time will reveal the true nature of this shift. From a technical analysis standpoint, Bitcoin’s price has rebounded at the 23.6% and 38.2% daily Fibonacci retracement levels, currently hovering around $144,100. Despite recent selling, the moving averages support an overall bullish trend, with expanding Bollinger bands indicating increased volatility due to profit-taking.

The Stochastic oscillator remains at neutral levels but below 50, suggesting a tendency towards selling pressure for now.

Euro strengthens as weak US jobs data impacts the dollar

The sharp downward revision in June non-farm payrolls and the subdued July figure significantly affected the US Dollar, evident across various markets. Notably, the Euro recorded a 2% intraday bullish move against the Dollar on August 1 following the job report release.

US 10-year treasury bond yields dropped from 4.37% to 4.22%, indicating bearish pressure on the Dollar. Simultaneously, European flash inflation remained stable at 2%, contrary to expectations of a decline to 1.9%, further strengthening the Euro against the USD.

Technically, the price found strong support at a key technical level, combining the 50% weekly Fibonacci retracement level, the lower Bollinger band, and the 100-day simple moving average. The price has since rebounded, with no significant technical signals of an imminent bearish trend.

Moving averages confirm the prevailing bullish trend, while the Stochastic oscillator hovers at a neutral level, suggesting potential movement in either direction in upcoming sessions. The most likely scenario is a bullish correction for the week, supported by expanded Bollinger bands signaling increased volatility.

Disclaimer: This sponsored market analysis is provided for informational purposes only. We have not independently verified its content and do not bear any responsibility for any information or description of services that it may contain. Information contained in this post is not advice nor a recommendation and thus should not be treated as such. We strongly recommend that you seek independent financial advice from a qualified and regulated professional, before participating or investing in any financial activities or services. Please also read and review our full disclaimer.