The Weak Labor Markets Pushes Dollar And Supports Gold

The current week in the financial markets was providing the pressure for the US dollar, as a response to the weaker than expected NFP report. EURUSD was strengthening, with Gold, Silver, Nasdaq and other cyclical assets rebounding after last Friday’s sell-off.

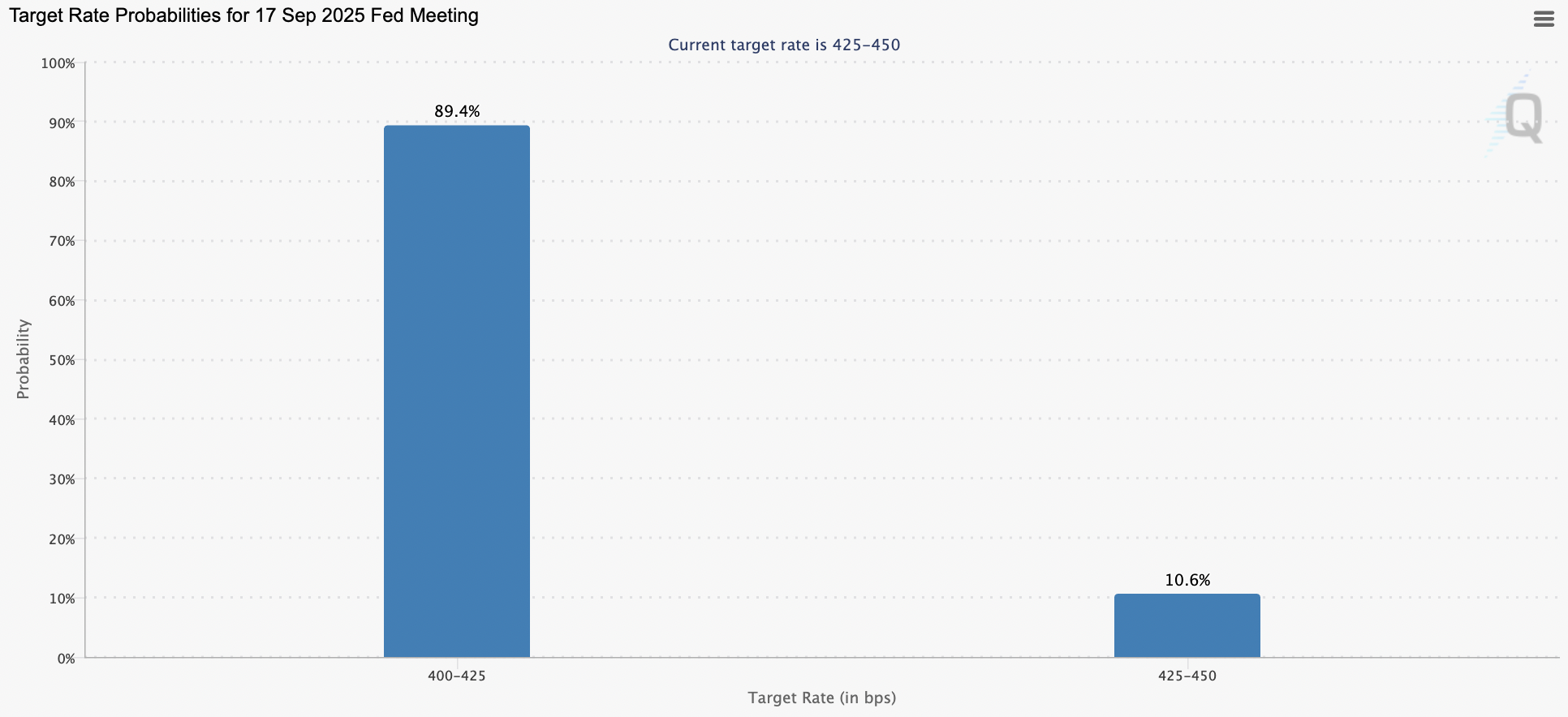

Probabilities of interest rate decline in September have shifted dramatically from over 60% at peak to below 10%, after the US labor market has shown cooling in July. PCE indexes have matched expectations, and now all eyes of traders will be focusing on the US CPI inflation report.

Despite the easing expectations about interest rates, volatility and risk appetite remain to stay modest, as summer markets’ slowdown dominates the action.

According to the Fedwatch tool from CME, the reduction of the FED’s interest rate in September is almost certain, and yields of 30-year bonds of the US decline, but not dramatically yet. Unless markets discover the latest CPI publication, big money will probably stay out of the game. The consensus forecast of CPI (Mom) is 0.3% against the previously published 0.2%.

The decline of the US dollar index has given limited support to stock indices and precious metals. Gold climbs with limited volatility but steady support from buyers, which keeps it from declining. The overall “sell America” narrative seems to be still active in the markets, though safe haven assets such as Japanese Yen and Swiss Franc, also display weakness.

Gold

Gold keeps moving in the context of the rising trend in a “stair-stepping” mode, finding responsive buying activity above the 20-day moving average. All intraday sell-offs seem to be absorbed by immediate buying, which indicates a steady demand for the Gold market, especially amid the weak NFP print for July and overall pressure for the US dollar.

COT-reports show the slight decrease of net position of commercial traders, but it’s still far from the bottom, which doesn’t translate it to a bearish signal of any kind. By the way, this year Gold had successfully ignored all “bearish” signals from COT reports, which essentially means that speculative and investment demand outperforms commercial supply.

Crude oil

Crude oil confirms the bearish trend, having pressured from intermediate-term peak. The fair price, according to the STEO forecast, stays at around $60 and that level might be perceived as a target area for the current price swing.

Geopolitical agenda adds more pressure on oil, as Steve Witkoff, the special negotiator from Donald Trump’s team, has visited Moscow and had a positive effect from talks with Vladimir Putin. Next week, markets will look forward to potential three-sided talks between Ukraine, Russia and the US. This situation adds more pressure to the already bearish Crude oil market.

One may think of cautious short positions in the direction of a price swing, closing it before “the news”.

Disclaimer: This sponsored market analysis is provided for informational purposes only. We have not independently verified its content and do not bear any responsibility for any information or description of services that it may contain. Information contained in this post is not advice nor a recommendation and thus should not be treated as such. We strongly recommend that you seek independent financial advice from a qualified and regulated professional, before participating or investing in any financial activities or services. Please also read and review our full disclaimer.